SQL Account GST

The best accounting software is now GST ready. Are you?

SQL Account provides a comprehensive yet easy to use GST module to help you get started with GST without hassle.

Time saving

Guaranteed accuracy

Peace of mind

Legit

Are you an accountant?

We are welcoming you to participate in a jointly organised GST seminar for companies

Please call 016-311 8181 (Desmond) or send an email for more details.

Integration with SQL Account

POS system, manufacturing software, e-commerce and many other 3rd-party systems are now readily integrated with SQL Account.

Introduction

What is GST?

Starting 1st April 2015, Malaysia will replace the existing sales and service tax with the goods and services tax (GST) which was announced during the Budget 2014 presentation.

Why GST? In a nutshell, GST is part of the government's tax reform initiatives to improve the taxation system to be more efficient, transparent and business-friendly.

And part of the package includes the introductory rate of 6%, reduction of corporate income tax rate and more.

Will it affect my business? Most probably.

The affect of GST to the current tax regime may vary from business to business.

This is due to it's broad-based consumption tax nature imposed at every stage of the supply chain.

Thus, tax payment is made by intermediary parties from product manufacturer to distributors.

Should I start now? Wait. How do I start?

Since the announcement, with a lead time of 17 months, businesses have to grasp the principle and mechanism of the GST.

It is an important first step into understanding the effects of GST and a stepping stone towards being GST ready.

Businesses can do so by enrolling into talks, seminars or workshops provided by various agencies.

Great. What more can I do to prepare?

Being compliant requires training, preparation and getting the right support group. Businesses may also consider using business software such as SQL Accounting as a GST tool.

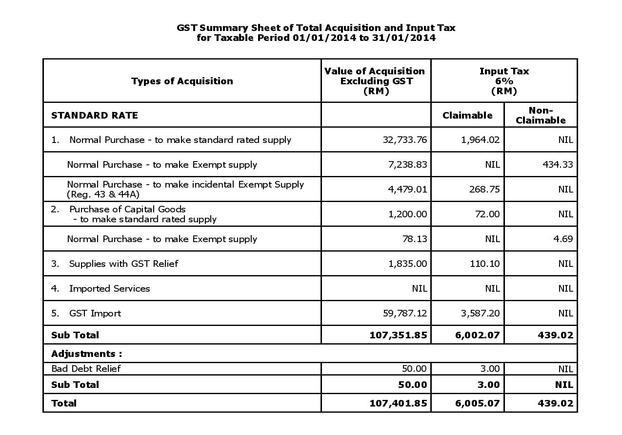

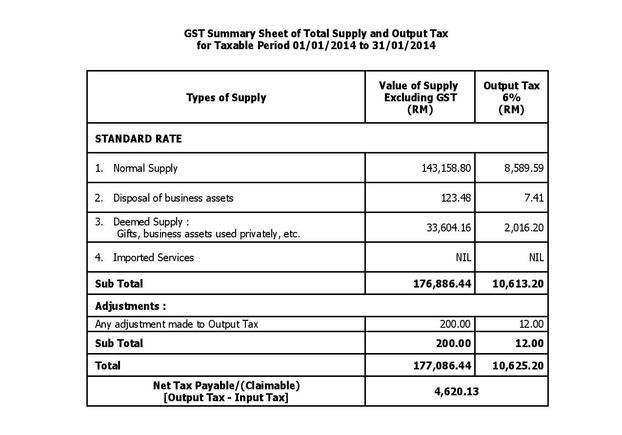

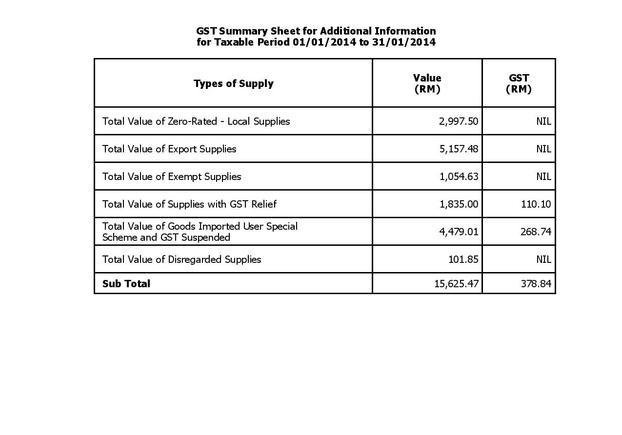

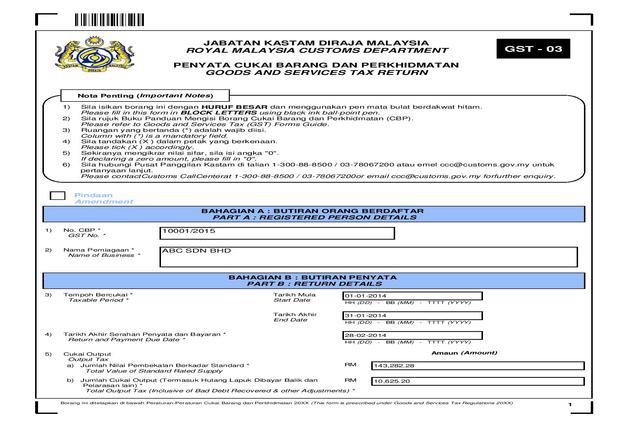

A GST compliant business software can help keep track of GST records and generate necessary reports for audit or decision making.

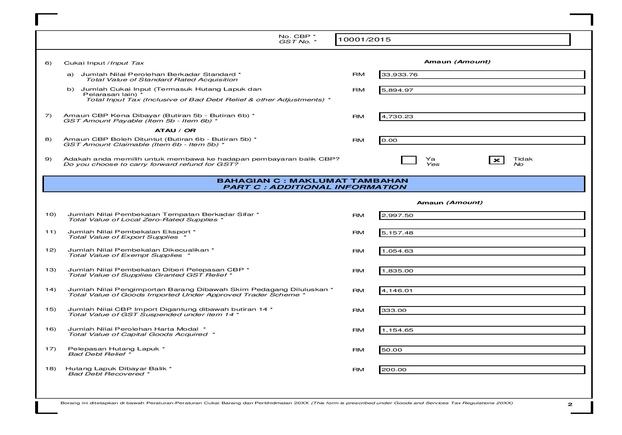

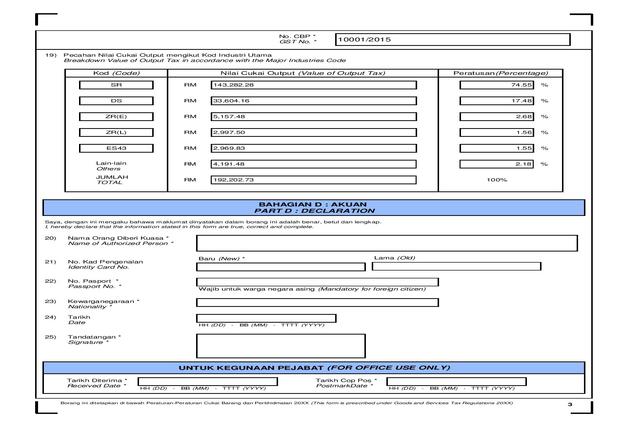

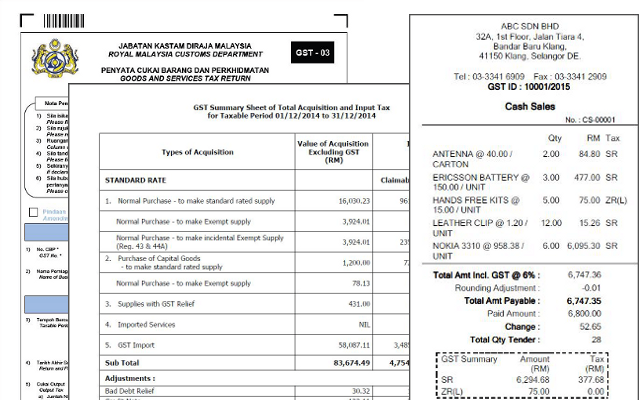

For example tax invoices, GST tax returns and etc.

Sample Downloads & Gallery

*All reports and documents are generated from SQL Account

Reports

Documents

FAQ

Like all business transaction a GST transaction is basically the same. That means you will need to record and keep track your business transactions one way or the other to comply with GST.

With that in mind, it is up to businesses to decide whether or not to use an accounting software as a GST tool.

Is SQL Accounting software GST compliant?

Yes. As a matter of fact, our GST module has already being used by some of our customers in Singapore.

In general, Malaysia and Singapore have its key differences and we tailor our software to make sure they meet each country's guidelines and requirements.

How do I know if SQL Accounting software is certified for GST?

A guideline is provided to all SME software developers to facilitate software development. To be an approved software provider of the GST, developers need to apply and pass the software demo.

At the time of writing, we had passed the requirements mentioned above and are now only waiting for Kastam Malaysia to process the letter of approval.