Hapenning Now

Get all the latest & past info on conference, talking gigs, seminars, training and more.

Sales and Service Tax 2018 : Transitioning to SST + Implication of GST Repeal in 120 days

SST commence and GST expected to repeal on 1 September 2018. Businesses, What’s Next?

Visit the event registration form page for full course outline.

Event Registration Form

Ongoing Events

SQL Account & SQL Payroll Free TrainingFor the month of June 2018

Sage UBS, MYOB or any non-SQL users are welcome to get training before purchase.

Event Registration Form

Past Events

Income tax audit convergence with GST audit + GST to SST Transition by Dr Choong Kwai FattMalaysia's Foremost Tax Expert

Full day seminar with ACCA Attendance Cert, HRDF claimable & lunch provided. RM 371

This is the first of its kind seminar to help business professionals to gain an edge on understanding transitional issues from GST to SST. The seminar will also completely unlock on the methodologies and mechanism evolving income tax audit and GST audit that is still ongoing.

Practical approach as to dealing on SST transitional issues, income tax issues, GST issues would be unreservedly shared. The practical guide to appeal to Special Commissioners of Income Tax (SCIT) and GST Appeal Tribunal would be discussed extensively.

Event Registration Form

Is your company ready on Your Company Ready From GST 6% to 0% & From GST 0% to SST?

Spend 4 hours of quality time learning "GST 6% to 0% later to SST" updates from

Mr. Song Liew, GST and Tax Expert

This event is free and sponsored by SQL Account. Users using other software are welcomed to join.

This seminar will discuss all these topics which businesses should take note of for smooth transition.

GST is O% and its tax implications, Latest update and development, Pricing Strategy and Display Price, Tax invoice and Record Keeping, Transitional issues, Claiming input tax, New tax codes, SST model and methodology, Questions and Answers

Event Registration Form

Latest GST updates and Employer Tax with Dr. Choong Kwai Fatt

Malaysia's Foremost Tax Expert

This events are organized and sponsored by SQL Account (E Stream Software Sdn Bhd)

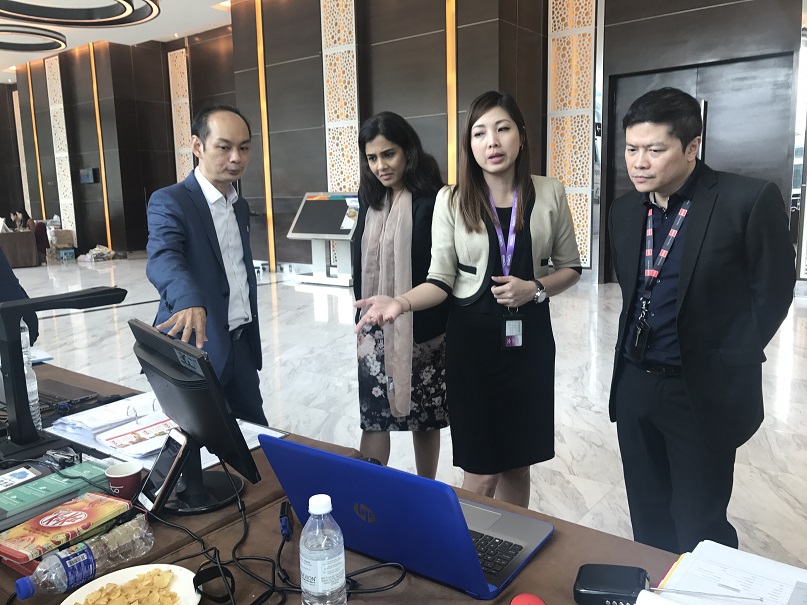

Event photo albums

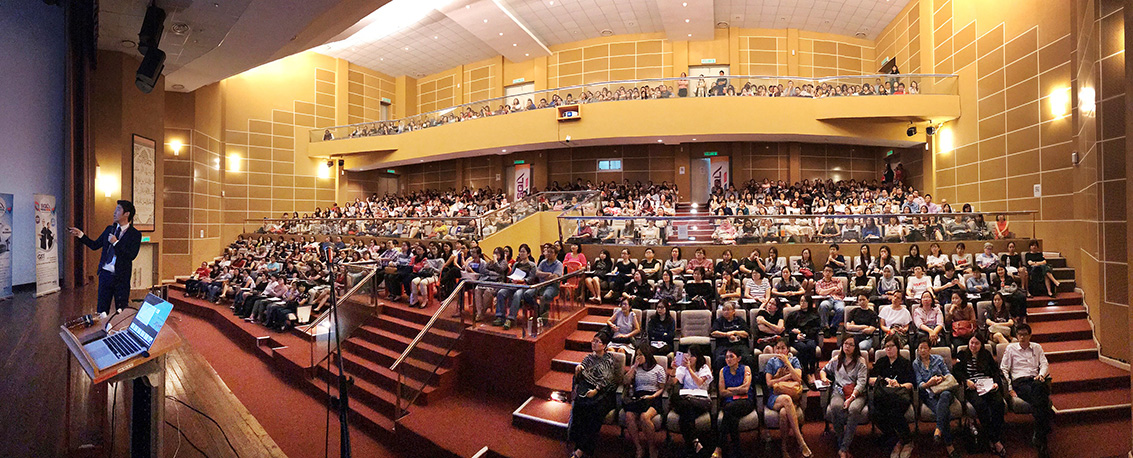

GST and Budget 2018 Seminar

Thank you 10,000 of you from Kuala Lumpur, Ipoh, Penang, Alor Setar, Kota Bharu, Malacca, Johor Bharu, Kuantan, Kota Kinabalu, Kuching who join our seminars. Every towns was overbooked in just one week and SQL Account appreciated all of the participants to make the event's success. LIKE our Facebook SQL Account - Estream HQ and stay tune on SQL Mobile LIVE for Android & IOS, SQL Evolutionary AI Technology, SQL Assets Tracking and others.

Facebook Live with Dr. Choong Kwai Fatt

- Withholding Tax & Import Services (Part 1 & 2) -

Go to our Facebook Live Page and click "Get Reminder" to get reminder notifications. This Facebook Live is sponsored by Estream Software (SQL Account).

Part I (Recorded Session)

Part II (Recorded Session)